As the world moves towards a greener future, the demand for battery packs is on the rise. Battery packs are used in a variety of applications, from electric vehicles to home energy storage systems. The cost of battery packs has been steadily declining over the years, thanks to advances in technology and economies of scale. The question on everyone’s mind is: how much will a battery pack cost in 2030? In this article, we will explore this question and discuss the factors that may influence the cost of battery packs in the future.

Battery Pack Cost Trends

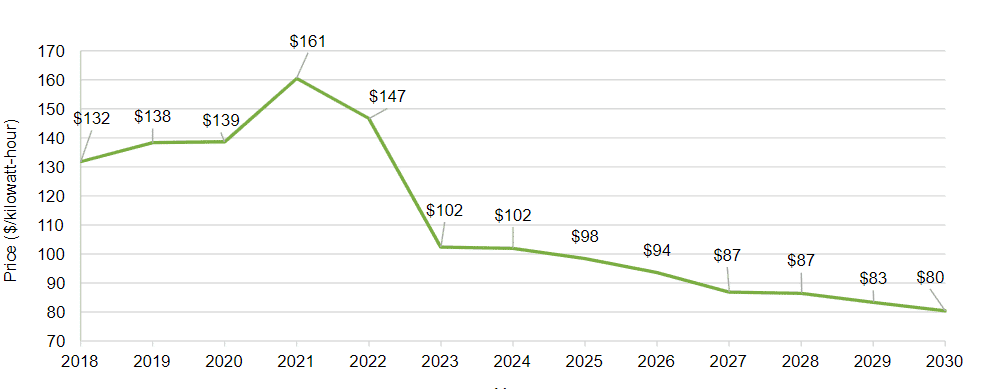

The cost of battery packs has been declining over the past decade. In 2010, the cost of a lithium-ion battery pack was around $1,000 per kilowatt-hour (kWh). By 2020, the cost had fallen to around $137 per kWh, a reduction of more than 85%. This sharp drop in cost has been driven by advances in technology, improvements in manufacturing processes, and economies of scale.

Experts predict that the cost of battery packs will continue to decline in the coming years. BloombergNEF predicts that the cost of a lithium-ion battery pack will fall below $100 per kWh by 2024, and will continue to decline to $58 per kWh by 2030. This is largely due to economies of scale as production of battery packs increases and more manufacturers enter the market.

Factors That Could Influence Battery Pack Costs in 2030

While experts predict that the cost of battery packs will continue to decline, there are several factors that could influence the cost in 2030:

- Technological Advances: Battery technology is constantly evolving, and new breakthroughs could lead to even lower costs. For example, researchers are exploring new types of batteries, such as solid-state batteries, which could be cheaper and more efficient than current lithium-ion batteries.

- Raw Material Costs: The cost of raw materials, such as lithium, cobalt, and nickel, can have a significant impact on the cost of battery packs. Any changes in the availability or cost of these materials could influence battery pack costs.

- Manufacturing Costs: As more manufacturers enter the market, competition will increase, which could lead to lower manufacturing costs. However, if manufacturing costs rise due to factors such as labor costs or supply chain disruptions, this could lead to higher battery pack costs.

- Recycling: Recycling of batteries can recover valuable materials, such as lithium and cobalt, which can be reused in new batteries. If recycling becomes more efficient and cost-effective, it could lead to lower battery pack costs.

What’s the battery growth forecast to 2030?

What’s the battery growth forecast to 2030? Currently, the grid has 30 gigawatt-hours (GWh) of battery storage globally installed. By 2030, we expect this number to reach 400 GWh. This has significant implications for utilities, battery storage investors, and large commercial energy users:

Utilities will witness a surge in battery installations in their areas. While some batteries will be utility-deployed, most will come from independent power producers, home and building owners, and operators of virtual power plants like Tesla and Sunrun. The structure of this buildout will determine the extent of utility ownership and control over distributed energy generation and aggregated distributed energy resources (DERs).

An electricity grid dominated by independent power producers may experience greater pricing volatility and reduced utility involvement. Utility-owned batteries will require substantial capital expenditure but enable the utility to retain ownership and operation of DERs, such as battery storage.

To meet the growing demand, investors will need to invest hundreds of billions of dollars in building terawatt-hours’ worth of battery installations. Allocating this capital wisely will be a crucial task for battery technology investors in the coming decade.

Customer-owned battery storage can capitalize on peak and off-peak hours to reduce monthly bills. In markets with high demand charges, commercial and industrial customers can achieve significant savings and shorter payback times for their battery assets, as discussed in our report “Capture the Benefits of Commercial Battery Storage.”

According to our forecast, Li-ion manufacturing capacity will surpass global demand through 2030. Our model, based on thousands of data points and employing a healthy dose of skepticism, predicts a sixfold increase in manufacturing capacity from today’s 510 GWh to over 3,100 GWh by 2030, ensuring a steady supply.

Conclusion

In conclusion, the cost of battery packs is expected to continue to decline in the coming years, driven by technological advances and economies of scale. Experts predict that the cost of a lithium-ion battery pack will fall below $100 per kWh by 2024, and will continue to decline to $58 per kWh by 2030. However, there are several factors that could influence battery pack costs in 2030, such as technological advances, raw material costs, manufacturing costs, and recycling. It will be interesting to see how these factors play out in the coming years and how they will influence the cost of battery packs in 2030.

Redway, a custom power storage wall manufacturer, is committed to developing innovative and cost-effective battery solutions. They specialize in the production of high-quality lithium-ion and lithium iron phosphate battery modules for a variety of applications. As the industry continues to evolve, Redway is dedicated to staying ahead of the curve and providing their customers with the most advanced and reliable battery solutions.

Related Posts

- Zapping the Voltage: A Simple Guide to Multimeter Testing for AAA Battery Voltage

- Will Voltage Affect Battery Performance?

- Will solid-state batteries replace lithium?

- Will Batteries Last Longer in the Freezer? Answers to Your Freezing Battery Myths!

- Will batteries last longer in the freezer?

- Will a 42V Charger Work on a 48V Battery? Understanding the Risks and Best Practices